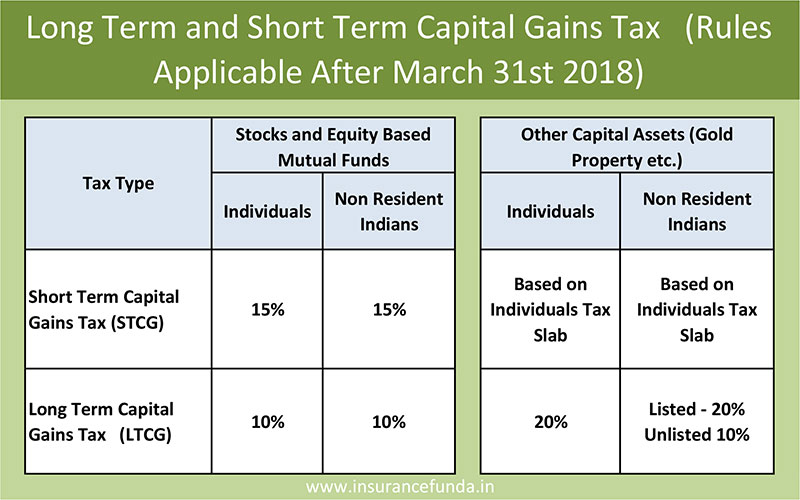

Short Vs Long Term Capital Gains Tax Rates

Capital ordinary income term long tax gain gains top stack bump zone separate brackets thresholds rates Term capital tax long gain ltcg short mutual funds vs stocks budget rates transaction stt securities Gains capital tax state rates term short

Capital gains tax rates: How to calculate them and tips on how to

Long term capital gain (ltcg) tax on stocks and mutual funds Capital gains tax rates: how to calculate them and tips on how to Gains tax rates infogram

Real estate tax benefits

Capital gains rates term income taxes selling gain taxed owe minimize calculate profits investments taxable lower twentyoverten earned cryptocurrency writecaliberTax estate real rates capital gains rate term short long income benefits taxes marginal brackets year much exhibit same shows How much tax is paid on short-term vs. long-term capital gainsCapital tax gains income return calculate term short long disclose gain rate assets livemint ltcg itr bracket money irs.

Gains rate taxation taxed taxpolicycenter bracket2014 short-term vs. long-term u.s. capital gains tax rates The long term capital gains tax is lower than the short term capitalCapital gains tax: everything you need to know.

The tax impact of the long-term capital gains bump zone

Capital gains term rates ordinary income brackets qualified bump dividend dividends preferential filing jointlyShort-term capital gains tax rate How to avoid the long term capital gain tax bump zoneShort term vs. long term capital gains on stock options and with it.

Gains brackets taxable income taxed depends filingTerm short long vs gains capital difference top between below Short term vs long term capital gainsHow to disclose capital gains in income tax return.